Navigating the complex world of taxes can be challenging. A qualified Tax Professional can provide invaluable assistance to ensure you reduce your tax liability. When choosing a CPA, it's crucial to look for their expertise in corporate taxation. A local CPA will be well-versed of the specific tax laws and regulations governing your area.

- Benefits of Hiring a Local CPA:

- Customized Tax Planning and Preparation:

- Cost-Saving Strategies

- Peace of Mind

Finding Top-Rated Tax Accountants Near You

Navigating the complex world of taxes can be a daunting task. Luckily, you don't have to go it alone! With our comprehensive directory, finding top-rated financial advisors in your area is simple and efficient. We list experienced professionals who are dedicated to helping you minimize your tax liability and affirm compliance with all applicable laws.

Whether you're an individual, a small business owner, or a large corporation, our directory has the perfect solution for your needs. Browse our comprehensive listings, read reviews, and connect with potential candidates directly. Take control of your finances today and uncover the value of working with a skilled tax accountant.

- Leverage our directory to find the perfect financial advisor for your needs.

- Streamline your tax filing process with expert guidance.

- Maximize your tax savings and affirm compliance.

Preparing Your Taxes Easy

Navigating the world of taxes can be a daunting task. With ever-changing regulations and complex forms, it's no wonder many individuals feel overwhelmed. That's where a trusted tax preparer comes in. A qualified professional can get more info provide expert guidance, ensure your filings are accurate, and help you maximize your savings.

When searching for a reliable tax preparer in your area, consider factors such as experience, certifications, but client reviews. Look for someone who is knowledgeable about the latest tax laws and has a proven track record of success. A good tax preparer will explain things clearly, answer all your questions patiently, and work diligently to protect your financial interests.

- Look are some tips for finding a trusted tax preparer:

- Seek family for recommendations.

- Examine online directories and professional associations.

- Schedule consultations with several potential candidates before making a decision.

Streamline Your Taxes with Neighborhood Services

Navigating the complexities of taxes can be a headache. Yet, there's no need to stress! Explore leveraging the benefits of local tax services. These specialists are dedicated to helping you boost your tax deductions and lower your tax bill. By selecting a trusted neighborhood firm, you gain access to specialized knowledge of tax laws and guidelines specific to your area.

A competent specialist can guide you through every step of the process, ensuring accuracy and compliance with all tax requirements.

- Additionally, local tax services often provide a tailored approach, adjusting to your individual financial situation.

- Therefore, you can benefit from focused advice and approaches that are perfectly aligned to your aspirations.

Tackling Professional Tax Help Just Around the Corner

Don't let tax season become a source of stress. With the right guidance, filing your taxes can be a smooth and efficient process. No matter if you have simple or complex finances, professional tax help is effortlessly available to guide you through every step.

A qualified tax specialist can examine your financial standing, identify all eligible deductions and, and ensure you utilize your tax benefits. Ultimately, this can result in significant savings on your tax burden.

Finding a reputable tax consultant doesn't have to be difficult. Start by inquiring friends and family for suggestions. You can also check out online directories that list certified tax professionals in your area.

Obtain Your Taxes Done Right - Find a Tax Professional Near You

Tax season can be a difficult time. With challenging tax laws, it can be tough to guarantee you're filing correctly and maximizing your deductions. Resist the pressure of doing it all yourself! A qualified tax professional can provide expert assistance to ease the process and possibly save you cash.

Finding a reputable tax professional in your locality is easier than you believe. Initiate by inquiring recommendations from friends, loved ones, or your financial advisor. You can also search online databases that specialize in tax professionals.

- During selecting a tax professional, consider their credentials and fields of concentration.

Make sure they are in top standing with the IRS and have a proven track record.

- Don't be afraid to schedule a meeting to explore your needs and request queries. A good tax professional will feel honest about their fees and strategy.

Angus T. Jones Then & Now!

Angus T. Jones Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Heath Ledger Then & Now!

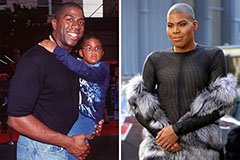

Heath Ledger Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Richard Dean Anderson Then & Now!

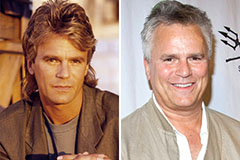

Richard Dean Anderson Then & Now!